Going digital? — face the tough questions first

‘Going digital’ has been the buzzword of the global insurance industry over the last few years as insurer

s look to exploit what the new breed of digital technologies have to offer. Traditional insurance companies have put on ‘digital hats’ to reinvent their businesses with products to cover previously uninsured risks, forged new business models with extended partnerships and dealt with an explosion of new channels and modes of

customer engagement.

A digital insurer can tap into high-volume, low-value business segments that have been traditionally unviable (e.g. microinsurance). Within commercial insurance, more complex products such as SME, financial lines and strata are also key opportunities. These have become an important growth strategy for insurers constrained within markets which are either commoditised or have been traditionally characterized by low penetration.

The key factors to success remains agility, low CapEx

and low OpEx coupled with an elastic technology to support flexibility and scale.

Without digital, online adoption stagnates due to legacy & an 80/20 rule focus. With Digital, a massive explosion of channels, products and service models allows for exponential growth in online business.

Most insurance companies have now appointed Chief Digital Officers (CDO) or similar to drive the creation of these new business and operating models. Those with a mandate to ‘Going digital’ have often found themselves in and unenviable position however. Apart from dealing with the fundamental challenges of defining just what ‘digital’ means, organizational silos often need addressing and hard-to-find digital talent must be sourced. Questions facing those tasked with this transformation include:

- How do we create and tailor products quickly for different digital channels?

- How do we launch through traditional and new channels quickly?

- How do we scale our servicing processes and systems to handle high-volume transaction spikes that could be created through various digital channels?

- How do we integrate and utilize different solutions offered by FinTechs and InsurTechs?

Thinking digital? Think middle office first

A critical factor for companies that have implemented successful digital strategies has been the adoption of a focused approach to agility and scalability.

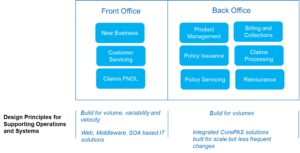

Traditionally, insurance companies and IT systems have been organized into front and back offices. The front office comprises the most customer facing functions and the back office provides service support to the front office and carries out other downstream functions of finance, accounting, reinsurance, etc.

With the advent of digital business, the role of the front office is diminishing – replaced by digital channels, either self-owned (e.g. portals and mobile apps) or provided by ecosystem partners (aggregators, brokers, InsurTechs, etc.). Distribution partners are now demanding more flexibility from insurers, such as headless interfaces which allow partners to fully control the workflow, user experience and embedded nature of an insurer’s product in order to suit their business drivers (and no longer be constrained by using insurer portals and the many associated usernames and passwords!).

This increased complexity creates further flexibility and scalability demands to meet servicing functions such as endorsements, claims and renewals plus product Management controls. How can insurers offer the needed product variances even within direct, broker, and agent channels without an explosion of product complexity at the back end?

The middle office as the solution to complexity

The first step to digitization does not need to be a ‘boiling the ocean’ approach of an end-to-end business and IT transformation (often led by a core system modernization). Insurers need to rethink the organization and architecture of back office systems and introduce an insurance middle office; a more agile and scalable approach than the traditional servicing organization and systems which were built to be a Back office (designed for batch operations and less frequent changes).

Rather than a one-size-fits-all approach to transform business functions and systems, with a middle office, insurers can adopt a focused, pragmatic and much faster strategy to modernization – starting with the business functions that matter most.

eBaoTech’s InsureMO – stand up a middle office in just weeks

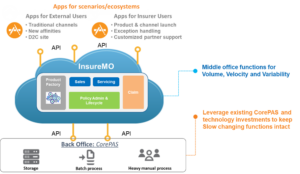

eBaoTech’s InsureMO is the solution that has helped insurers around the world meet their digital challenges and rapidly stand up the front office and middle office over their existing back office (Core PAS) systems.

The InsureMO solution not only catalyses the digitization process but also keeps the CapEx and OpEx low, allowing digital insurers to rapidly explore and experiment with newer digital channels.

- A middle office enabler for insurance to meet the digital business needs of massive volume; variation; velocity

- Backed by a super flexible product factory and libraries of insurance products and components

- Provides a comprehensive API library to service insurance middle office functions

- Fully microservices architecture to leverage the full scalability potential of a cloud-based infrastructure

- Enables rapid connectivity to ecosystem, InsurTech’s and insurers’ core systems

- For a view to middle office implementation from an IT architecture perspective, read our thought paper – Rethink Enterprise Architecture for a Digital Insurer

- For recent digital success stories with eBaoTech’s Insure MO: