あらゆるアプリに対応、

あらゆる製品を立ち上げ、

あらゆるチャネルを接続

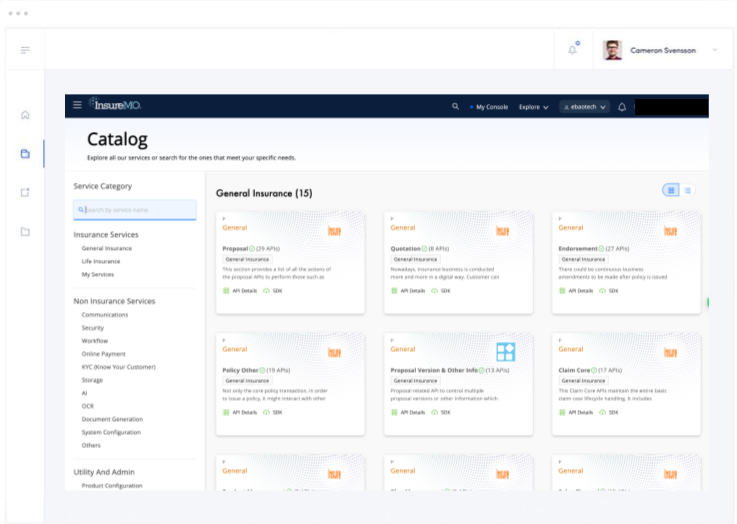

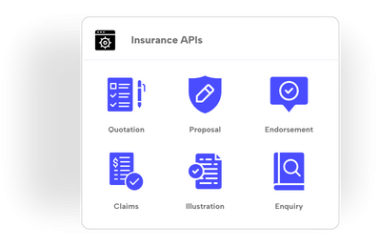

InsureMOは、17,500以上の商品、10,000以上のAPI、そしてエコシステム全体にわたるシームレスな接続性により、保険会社、ブローカー、インシュアテック企業のイノベーションを加速させます。レガシーシステムを変革し、デジタル保険戦略をグローバルに展開しましょう。

ダイナミックな

エコシステムへ

保険の革新

InsureMO: 保険会社とエコシステムを創る保険販売を実現

AI主導の

保険変革

強化されたインテリジェントエージェントによるファインチューニングモデルと知識ベース意思決定

InsureMOは、世界最大級のミドルウェアプラットフォーム

大規模な保険エコシステムの構築を実現

0億米ドル

0+

0+

0+

Create & Connect

保険会社、ブローカー、MGA、技術パートナーが、イノベーションとデジタルエコシステムの拡大をInsureMOで実現

保険インフラににおける全く新しい考え方

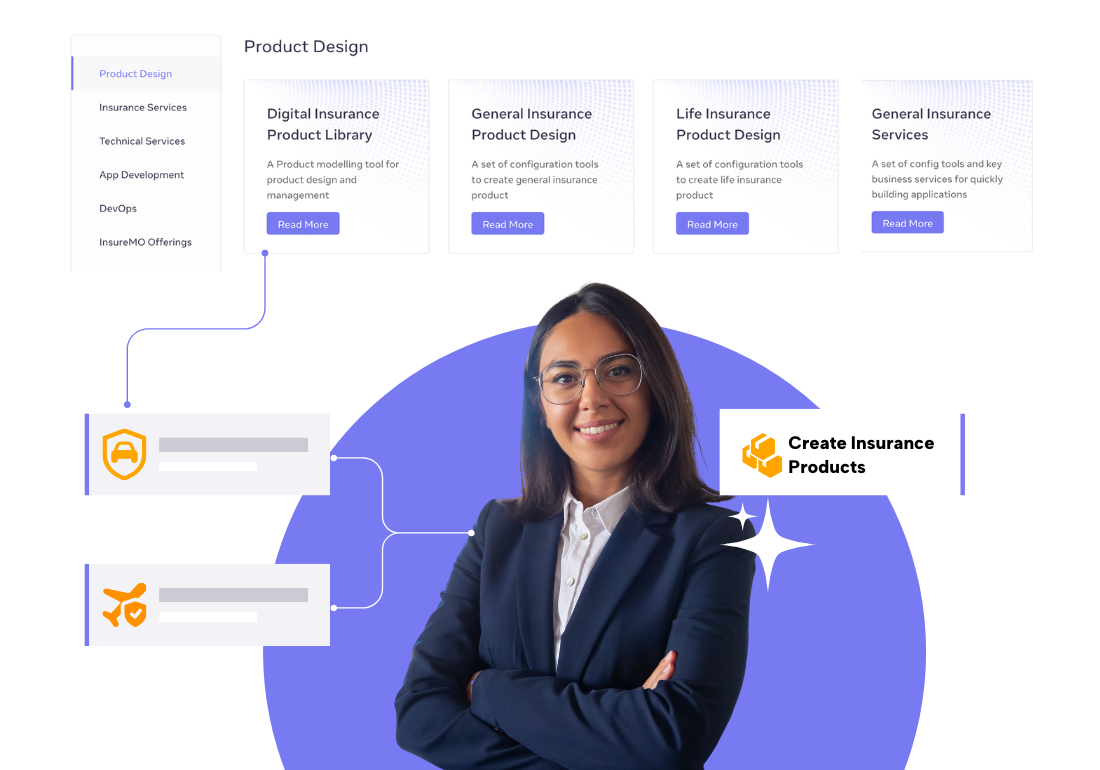

InsureMOは、ビジネスの成長に不可欠な商品、APIを網羅したPlatform As A Service (PAAS)です

AIで保険業務を革新

インテリジェント・オートメーション時代の事業変革方法を解説

保険イノベーションを加速

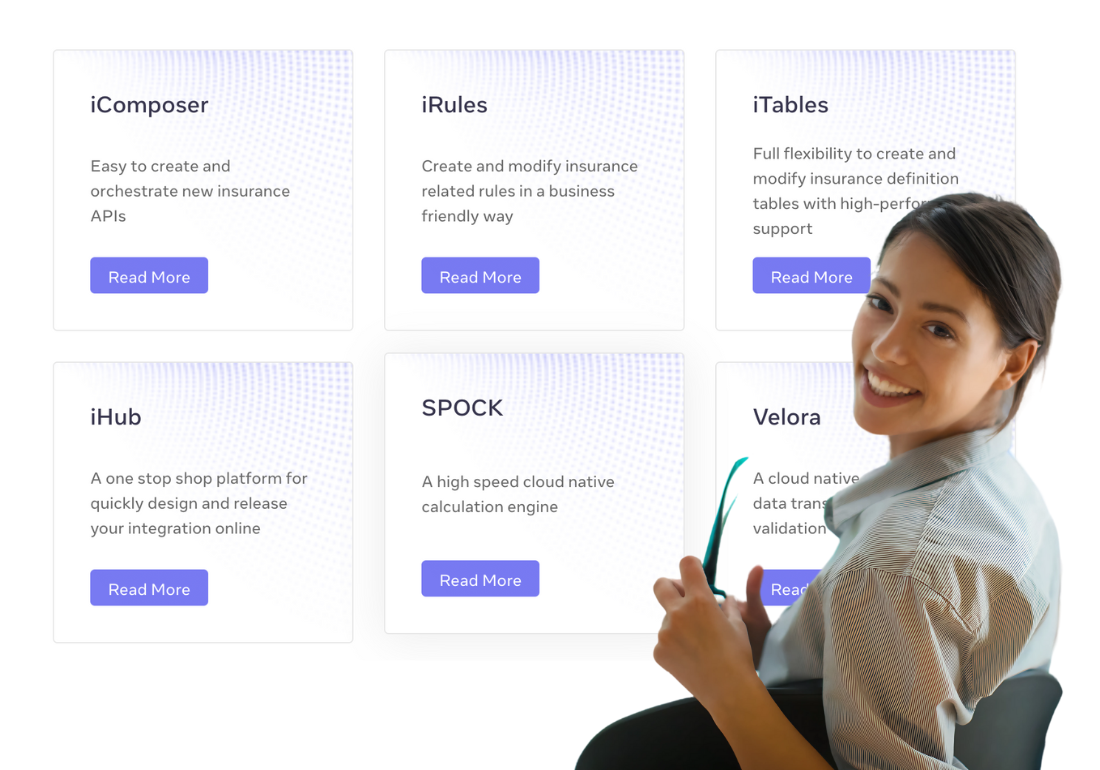

10,000以上のAPIを備えた強力なプラットフォームで、コアの最新化・エコシステム統合・AI駆動のイノベーションを実現

迅速なイノベーションと市場投入

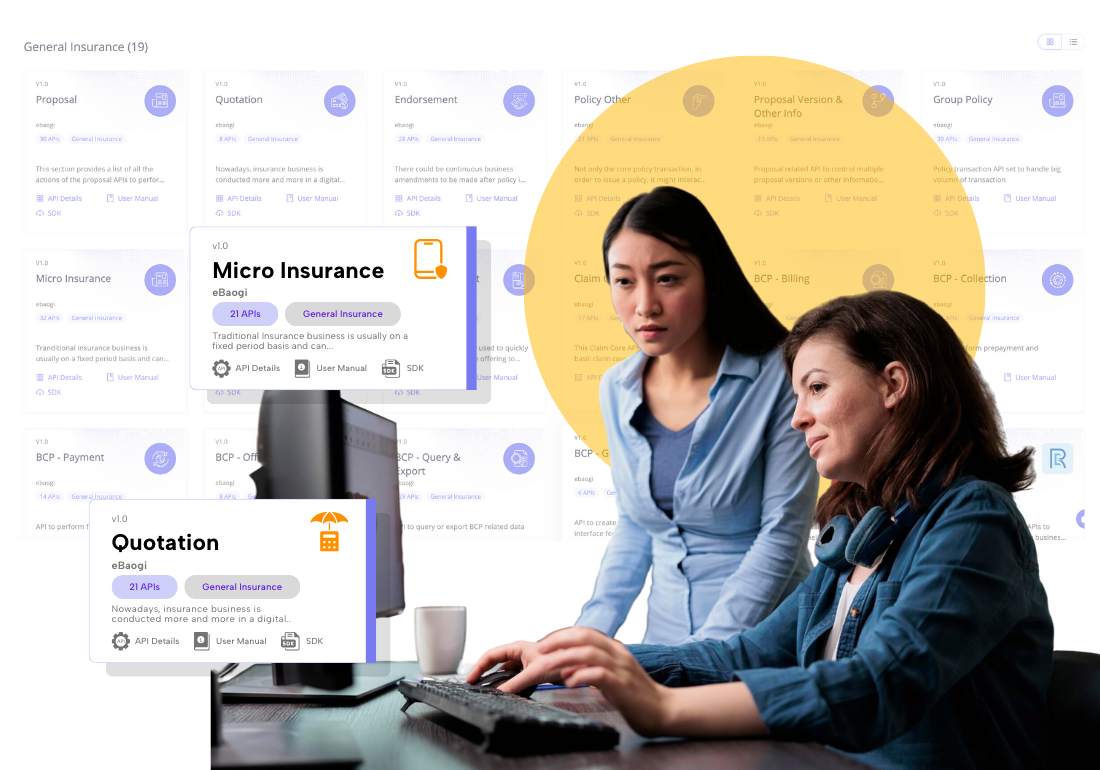

InsureMOの1万超のAPIと1万7500以上の即利用可能な商品ライブラリで、新商品を数週間でリリース。競争市場での優位性を強化します。

スケーラブルなクラウドネイティブ構造

マイクロサービス・APIファースト・クラウドネイティブ・ヘッドレス(MACH)構成により、大量取引も高速かつ効率的に処理。ビジネス成長に合わせて柔軟に拡張可能です。

多様なエコシステム連携

InsureMOは自動車・モビリティからヘルスケア、旅行まで、あらゆるエコシステムと連携可能。多様な顧客向けに高度な保険商品を展開し、市場拡大を支援します。

"Choosing InsureMO as our mid-office platform is a significant step in Oona's digital transformation journey. Their capability to seamlessly create and connect diverse distribution channels gives us an edge, allowing us to accelerate our time to market for new and existing products. This partnership isn't just about technology—it's a partnership towards creating an insurance-as-a-service model for future-ready insurance carriers."

Abhishek Bhatia, Founder and Group CEO,

Oona

,,

"InsureMO has achieved significant recognition by receiving four Service Ready Certifications from Amazon in the first half of the year. Recently, the company added three more certifications—AWS Graviton Ready, AWS Lambda Ready, and Amazon Linux Ready. This accomplishment reflects InsureMO's commitment to innovation and its ability to provide best practices, robust product offerings, and cost-effective solutions within the industry."

Bob Zhang, Solution Architect Manager,

AWS Financial Industry

,,

"To achieve our vision of providing insurance and medical services to every 'member of the family,' we are pursuing technology and redefining established practices with technology as the foundation—thereby innovating the value we can deliver to our customers. Based on advanced microservices architecture, we considered and began technical verification of InsureMO, an InsurTech PaaS (Platform as a Service) proven overseas, for adoption."

Kazuhiko Itaya, President,

Little Family Small-Amount Short-Term Insurance

,,

"The situation of the core system varies depending on the insurance company, but InsureMO minimizes the impact of that core system and flexibly responds to the touch points with end-users such as policyholders and insurers in a relatively short period of time and at low cost. I think that's what we're providing value."

Ando Akihiro, General Manager, Insurance IT Service Division,

NTT Data

,,

"We at SBI General, have always been at the forefront of digitization. We are consistently strengthening our digital distribution networks / channels by working on systems and processes that support our extensive network of distributors, including Bank branches, coupled with an equally large product portfolio which makes it cost effective and sustainable. We meticulously choose and work with our tech partners to ensure that we provide our distributors and end customers with the most effective, innovative latest state of art technology solutions through their preferred modes and platforms. Our partnership with InsureMO is one of such initiatives in this direction".

Anand Pejawar, Deputy Managing Director,

SBI General Insurance

,,

"The synergy between Qantev and InsureMO is a new era for the insurance industry. By combining our Claims AI expertise with InsureMO's insurance platform, we are setting a new standard for what is possible when it comes to transforming insurance operations and customer service. This partnership is a step forward in our mission to enhance the performance of health and life insurers around the globe using cutting-edge AI."

Tarik Dadi, CEO,

Qantev

,,

"We are thrilled to unveil this strategic partnership with InsureMO. This collaboration is a giant leap toward revolutionizing the insurance sector. Together, we leverage the transformative potential of low-code technology to fuel innovation and set unprecedented industry benchmarks."

Rajvinder Singh Kohli, Senior VP and Head of Global GSI,

Newgen

,,

"We are thrilled that by leveraging InsureMO, Chubb is able to further enhance our digital customer experiences by offering more customized products across SEA market in a much more cost-effective and efficient manner and to greatly expand our distribution networks by embedding insurance business into more affinity partners’ ecosystems/user journeys such as Banks, Fintech, Telco, eCommerce, etc. Furthermore, InsureMO platform, as a middle office layer, provides us with the technology capabilities to integrate with the latest AI apps and capabilities while keeping our core policy admin system secure and stable."

Ravindra Venisetti, Global CTO,

Chubb Life

,,

"The InsureMO platform is used successfully by insurers, brokers, agents and affinity channels, and our combined solution will ensure their rating requirements will continue to be fulfilled as markets become increasingly competitive and in need of agile and sophisticated pricing strategies".

Andrew Harley, Director,

Willis Towers Watson (WTW)

,,